Spare your two minutes to know about- How to close Credit card ICICI;Close EMI in ICICI credit card;Close ICICI credit card account;Close ICICI credit card loan;Close ICICI credit card online;Close ICICI coral credit card

How to close ICICI credit card? The process is straightforward. But, sometimes, ignorance of this essential process cost us a loss in terms of our bank credit points. Many people could not manage the required credit point due to adopting not the complete process of closure.

Our research team is sharing complete information related to the closure of ICICI bank varieties of credit cards, closure of EMI of ICICI credit cards, temporary closure of ICICI cards, closure of ICICI credit cards; loans, etc.

You require to go through all the pointwise information shared below lines; It would not take more than 120 seconds of your valuable time.

- How to close Credit card ICICI

- Close EMI in ICICI credit card

- Close ICICI credit card account

- Close ICICI credit card loan

- Close ICICI credit card online

- Close ICICI coral credit card

- Close ICICI credit card temporarily

- Close ICICI credit card permanently

- Pre Close ICICI credit card EMI

- Close ICICI credit card through net banking

- How to Close my ICICI credit card account online

- How to pre Close ICICI credit card personal loan online

- ICICI credit card customer care

- Pros and Cons

- Conclusion

- Frequently asked questions

How to close Credit card ICICI

A few simple steps you have to follow to close or cancel your ICICI credit card. The best way is to check three requirements before closing the credit card. These three requirements are – all the dues on a credit card are cleared, all the earned credit points are already redeemed, and lastly, there is no further scheduling of any payment.

You can adopt the following process-

- Through Customer Care Services: Dial the toll-free numbers 18601207777 ( for personal credit card), and 18601206690 (for Corporate Credit card). Request for deactivation and closure of credit card.

- The deactivation and closure process through Customer care is an automated computerized system, you require your credit card number there. Keep it ready.

- In the deactivation and closure process, finally, you have to provide them with the one-time password (OTP) received on your registered mobile.

- You have to do all the processes by your mobile registered in ICICI Bank.

- Usually, the bank takes three working days to close your credit card, the bank will inform you about the closure of the credit card in your registered email ID and through sms on your phone.

- The last and most important point, which usually we neglect, is checking of proper closure of your credit card through your SIBIL report.

- SIBIL reports are freely available online through many agencies, you can see that your ICICI credit card is closed and there are no outstanding dues. If there is any mistake, you are advised to correct it with the help of ICICI bank official. Otherwise, this will pose a problem with your credit score.

Close EMI in ICICI credit card

If you want to cancel EMI scheduled for any of your purchases done through ICICI credit card, you have to do it within 48 hours. However, the case of a loan against the credit card does not have 48 hours barrier, but one has to pay 3% of the total outstanding amount as pre-closure charges.

The following steps require for the closure of EMI in ICICI credit cards-

- Pay the outstanding amount of money/loan. You have to pay interest also @ 3% of the total outstanding in case of credit card loan.

- You have to contact customer care at 18601207777. Automated customer care will ask for your related work. Press the number instructed for the closure of credit card loan EMI.

- Provide your credit card twelve-digit number by pressing your phone keyboard.

- Press the OTP number received on your phone.

- You will receive a message about the closure of your EMI of loan.

Close ICICI credit card account

There are different ways to close the ICICI credit card account. One can close it with the help of the customer care helpline, by using online banking, by post, or by visiting the nearest ICICI bank branch.

- If you want to initiate the closure online, first, you have to log in to ICICI credit card account.

- After logging in, go to the credit card section and choose to deactivate option.

- Go to the mailbox, open the email option; write closure of credit card as the subject. Write the Manager, Customer care that you have deactivated your credit card account attached to such and such saving account number and request him to close the credit card facility.

- You will get a reply of closure in your online banking mailbox as well as in your registered email ID and message on your registered mobile phone.

- You can visit the local branch of ICICI; Please; Please go with your details of saving/corporate account, Bank will provide a printed requisition for the closure of the credit card account or you write an application to manage to close the credit card attached with such and such saving bank account number.

- Please never share any confidential information such as a password or OTP etc. related to the credit card with anyone.

Close ICICI credit card loan

Closure of ICICI credit card personal loan is possible, but one can do it after payment of one installment of the loan. A personal loan through ICICI credit card requires the following point to fulfill –

- There is a pre-closure of loan bank charges equal to 5% of the total outstanding amount plus the GST. You need to clear this point before proceeding with the closure application.

- Another point is that the outstanding amount has to pay by the borrower’s account and not from the balance transfer.

- If the outstanding amount of money is more than INR 50000, then a copy of the PAN card is required to submit along with the application form.

- One pre-closure statement from the bank is required to enclose.

- Pre-closure of the personal loan along with PAN card and application form you have to submit.

- When you clear the amount of money, then the bank will provide you with a receipt related to the closure of your loan.

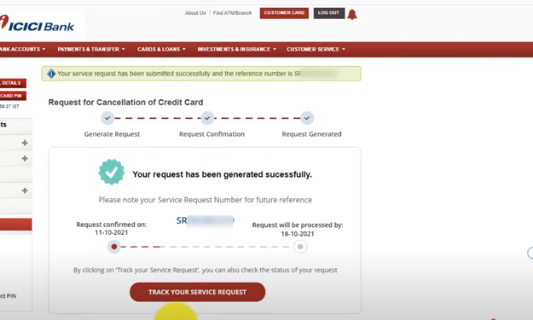

Close ICICI credit card online

The online facility to close the ICICI credit card has a few simple steps; we are sharing them pointwise.

- Online closure of ICICI credit cards requires the first deactivation of the credit card by logging in to the ICICI bank portal.

- Once you enter into the online banking, you will get the option of the credit card on the left side on the upper end of the screen. From there you have to go to the deactivation after scrolling it down.

- Go to the mailbox on the right side up, and open the email.

- Send an email to Manager Customer care to close your credit card attached with a such and such saving account, and there is no outstanding amount against the credit card.

Close ICICI coral credit card

HPCL coral credit card is having a unique feature for the airport lounge and is also known for high credit points. Before processing the closure of the ICICI coral credit card, it is advisable to check that all the earned credit points have already been exhausted. Otherwise, these will be lost away.

You can take the following steps to close the coral credit card-

- Call the toll-free number of customer care at 18601207777. Request for deactivation and closure of credit card. You will listen to the voice of the automated machine, asking you to press a specific number.

- Press the number for Deactivation and closure. Keep the credit card number ready. Enter the credit card number, when asked to do so.

- For the closure process, you have to enter the one-time password (OTP) received on your registered mobile.

- The usual time to close the credit card is three working days too; the bank will let you know about the closure of the credit card through SMS and mail.

- It is advisable to check the closure of your credit card through your SIBIL report.

- SIBIL report is available online through many agencies; you can quickly check the correct status of the closure of your credit card.

Close ICICI credit card temporarily

Sometimes temporary closure of the credit card becomes essential for security purposes or due to other reasons. You can do it online or by customer care services of ICICI bank.

- For an online temporary closure process, you have to log in to internet banking. Select the credit card option and scroll the browser and click deactivate. The card will be deactivated, i.e. temporary close, you can activate it again at any time.

- You must check before deactivating the credit card that there should not be any outstanding amount against the credit card; otherwise, you may have to pay a significant interest later on.

- The second option is to contact the customer care of ICICI. The customer care number of ICICI is 18601207777. You can dial and request for temporary closure.

ICICI credit card customer care

ICICI Customer Care Services: Dial the toll-free number 18601207777 ( for personal credit card), 18601206690 (for Corporate Credit card).

Pros and Cons

| Pros | Cons |

| ICICI credit card closer facility is convenient and easy. You can do it taking the help of customer care, using online banking, or by visiting the ICICI bank branch. To close the ICICI credit card, you can take the help of customer care number 18601207777. You can go and meet the manager of the local branch of ICICI to close a credit card. | You must clear all the outstanding due before the closure of the credit card. |

Conclusion

How to close the ICICI credit card? The answer to this question is very crucial as it is related to our CIBIL report. Closure of ICICI credit cards properly is significant. There are different ways the closure a credit card. One can do it by using the ICICI customer care number. One can use online banking also. Even by visiting the nearest ICICI Bank branch, one can proceed with the closure of the ICICI credit card.

Frequently asked questions

Can my remaining credit point will be forwarded to my bank account after tNo, You have to redeem all the credit points you have earned before the process of closure. If you forget to redeem, then points will be lost. There is the provision of transfer of credit card to another card, you may think to do so if it fits you.he closure of the credit card?

How to close a supplementary ICICI credit card?

The process of closure of supplementary credit cards is similar to the closure of leading credit card. the second card is also having a separate card number and all the transactions, and other related issues are maintained by the bank as a single entity. Hence, to close the second credit card attached to the principal one, you have to contact the customer care department of ICICI bank and request them to close it.

How much time it takes to reflect the closure of my ICICI credit card in SIBIL Score?

No time, immediately after the bank officials complete the closure process, it starts reflecting in your SIBIL report. SIBIL reports or scores are computational programming-based systems, hence least physical involved in updating it for a person.

Is there any formula related to SIBIL score and credit card transactions?

It is computer programming having the involvement in all the transactions, bill payment, loan taken, and repayment. There is not any single simple mathematical formula for it.

Can I do the closure the ICICI credit card by email?

You can do it. You have to use the email facility available in your mailbox of ICICI bank internet banking. First, you have to deactivate your credit card through internet banking, then you have to mail the Manager Customer care to close your credit card.